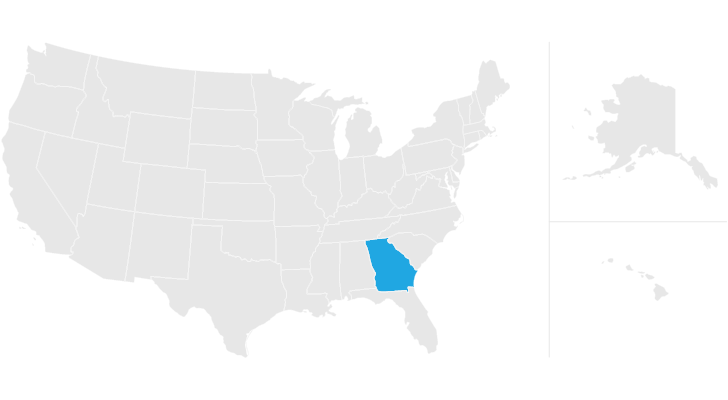

georgia estate tax laws

The effective rate state-wide comes to 0957 which costs the average Georgian 155130 a year based on the median home value in the state of 157800. The Department issues individual and generalized guidance to assist taxpayers in complying with Georgias tax laws motor vehicle tag and title laws and regulatory and licensing requirements.

Georgia Estate Tax Everything You Need To Know Smartasset

Taxes are unavoidable in any state.

. If a person that owned a home with a fair market value of 100000 in an unincorporated area of a county where the millage rate was 2500 mills that persons property tax would be 95000-- 100000 40 - 2000 02500 95000. Georgias estate tax is based on the amount allowable. In Georgia most people do not pay any taxes when they die or inherit money or property from someone who has passed on.

In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law. 48-5-7 Property is assessed at the. Property Taxpayers Bill of Rights.

Multiply 100000 by 40 which is equal to the assessed value of 40000 and subtract the homestead exemption of 2000 from the. The bill has two main thrusts. Senate Bill 177 Act 431 was signed April 30 1999 and became effective January 1 2000.

Property and real estate laws affect renters and landlords as well as home owners or prospective home owners. For Businesses the 1099-INT statement will no longer be mailed. Before assuming that an estate is exempt it is critically important to analyze the estate because many assets such as life insurance are commonly overlooked when determining whether an estate must file an estate tax return.

Only people who die with more than 117 million must pay the federal estate tax and Georgia does not. Property Tax Returns and Payment. The tax must be paid by the person who executes the deed instrument.

Houses 8 days ago The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or fractional part of 100. In a county where the millage rate is 25 mills the property tax on that. Most states including Georgia have homestead protection laws allowing property owners to protect a small parcel of property from creditors and adverse possession laws which allow continuous trespassers to gain title to an otherwise abandoned piece of.

In Georgia when an investor purchases a tax deed they do not immediately get possession of that property. For instance only 1 percent is taxed on the first 750 of persons income but 6 percent for income over 7000. Once the original owner is properly notified about the sale they have a one-year right of redemption during which time they can pay off the tax deed plus interest and penalties.

This QA addresses whether a jurisdiction has any estate tax or other similar taxes imposed at death and for jurisdictions currently imposing a state estate tax includes an overview of the state estate tax system the basic exemption amount the calculation of the gross estate available. It is not paid by the person inheriting the assets. Wills Trusts and Administration of Estates.

And while no one enjoys paying taxes they help fund important public services such as roads public schools fire departments and other entities we depend on daily. Georgia Code Title 53. Georgias estate tax for estates of decedents with a date of death before January 1 2005 is based on federal estate tax law.

This 1099-G form is for taxpayers who itemized deductions and received a refund credit or offset. Currently Georgias tax lien interest rate is 20. Property in Georgia is assessed at 40 of the fair market value unless otherwise specified by law.

Georgia law is similar to federal law. A QA guide to Georgia laws on estate taxation of transfers at death. In Georgia personal income tax laws offer lower rates for lower-income individuals.

Taxpayers now can search for their 1099-G and 1099-INT on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. Property Taxes in Georgia.

Written guidance is in the form of Letter Rulings Regulations and Policy Bulletins. State residents and non-resident individuals with taxable net income from property or business in the state must file personal income taxes. The tax is paid by the estate before any assets are distributed to heirs.

Wills Trusts and Administration of Estates. Real Estate Transfer Tax Georgia Department of Revenue. Georgia Property Tax Rates.

Due to the high limit many estates are exempt from estate taxes. The law provides that property tax returns are expected to be filed with the county tax receiver or the county tax commissioner between January 1 and April 1. Prevention of indirect tax increases resulting from increases to existing property values in a county due to inflation Enhancement of an individual property owners rights when objecting to and appealing an increase made by a.

According to OCGA. Current as of April 14 2021 Updated by FindLaw Staff. Property Tax Homestead Exemptions.

Under Georgia tax laws those earning more than 7000 pay a 6 percent income tax rate while counties and local municipalities are free to levy an additional 1. Wills Trusts and Administration of Estates. County Property Tax Facts.

The assessed value--40 percent of the fair market value--of a house that is worth 100000 is 40000. Property Tax Millage Rates. This is FindLaws hosted version of Georgia Code Title 53.

48-5-18 Georgia property tax is due on property that was owned on January 1 for the current tax year. Important Links Attorney Generals Office.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Benefit From Low Tax Jurisdictions And Save Money On Taxes

Here S How Settling An Estate In Georgia Work Faulkner Law

Georgia Inheritance Laws What You Should Know Smartasset

Georgia Inheritance Laws What You Should Know Smartasset

Georgia Retirement Tax Friendliness Smartasset

Here S How Settling An Estate In Georgia Work Faulkner Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Probate A Will In Georgia Legalzoom Com

Does Georgia Have Inheritance Tax

Here S How Settling An Estate In Georgia Work Faulkner Law

Georgia Estate Tax Everything You Need To Know Smartasset

What Do I Need To Know About New York State Gift And Estate Taxes Russo Law Group

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

Here S How Settling An Estate In Georgia Work Faulkner Law

Does Georgia Have Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die